Since becoming Minister of Economic Affairs, Wang Chih-kang has been pushing the "Invest in Taiwan" initiative to great effect, appearing as a "Master of Promotions." However, beneath the shining surface of his brilliant success lies his determination to produce results. Below are excerpts from our exclusive interview with Minister Wang.

Q: Why is it that the Minister of Economic Affairs would put forward an "Invest in Taiwan" initiative at this time? Could you tell us some of the more concrete reasons?

A: Beginning last year, Taiwan's economy began to show signs of a recession. Throughout the economy, the growth rate of investment has been showing a trend towards slowing. Trade has even shown negative growth, something which has never happened before. At the same time, the unemployment rate has been steadily climbing. These are all signals. On the other hand, enthusiasm for overseas investment, especially for investment in the mainland, has remained extremely high. For this reason, we need to first strengthen our foundation, to make our domestic economy prosper, and with surplus generated by such efforts, we can then engage in overseas investment. With this in mind, I and some friends from commerce and industry, such as C.Y. Kao, are loudly leading the movement for investment in Taiwan.

The rush solicit business

In fact, since I was appointed, I have been in active touch with commerce and industry. My friends there had been planning to go overseas or to the mainland with their investments, but now we are making our best effort to encourage them to invest domestically. After considerable effort, we've begun to see a high level of interest in domestic investment among most manufacturers. And many have pledged considerable amounts of money. For example, Far Eastern's Hsu Hsu-tung has pledged NT$20 bn to investment in Taiwan, NT$6 bn of which is already set to be invested in the first quarter. These kinds of investment pledges are accumulating; their value exceeds something like NT$200 bn. Of course, this NT$200 bn will not all be invested immediately; we'll take these projects and assess them one at a time.

In addition, according to statistical data from the Directorate-General of Budget, Accounting, and Statistics (DGBAS), for each year-on-year NT$80 bn increase in the amount of domestic investment, the economic growth rate will be raised by one percentage point. This year's economic growth rate is forecast to fall below 6%, which is something we are all quite anxious about. However, we feel that if investment can continue to grow, then the economic growth rate will recover again. And I hope we will be able to see the results as early as next year.

In addition to encouraging local business people to invest in Taiwan, we are making strong efforts to attract foreign investment to Taiwan. For example, in the past, the Industrial Development and Investment Center spent a great deal of time taking manufacturers abroad to invest. In effect, they became the "Center for Overseas Investment." I told them they should change their name to the "Business Solicitation Bureau" and get to work on bringing more foreign business people to Taiwan. Now they are actively working on it.

Of course, if we want to promote investment in Taiwan, the government cannot pass the buck on providing a good environment for that investment. We must assist manufacturers in clearing away the obstacles that they face. To this end, we've established several committees to focus on a few important problems. We meet every week to discuss what progress has been made, and for every important investment plan, we ask the relevant division (the Industrial Development Bureau) to make a report on what progress has been made and what we can do the following week. The next week, we meet to review the results. In this way, we've been moving the projects along one by one. There are investment plans that have been delayed for years, like that of Taiwan Cement, that are now being resolved.

No excuses

There are also the industrial/commercial mixed-use zones which are an important part of the plan to revive the economy and one of the government's twelve economic stimulus initiatives. But this issue is tied up with the thorny problems of rezoning and land use. For the past two years, there was no progress made at all. Finally, we established a committee to review every application individually, and we assigned responsibility for each case to a specific person. After a period of very hard work, we have six or seven which are ready to go. The first is an extremely important proposal for a large shopping center in Chungli. It involves 15 hectares of land and investment totaling about NT$15 bn.

Besides this, there are also plans for privately owned power plants which easily involve investments of NT$10~20 bn. We have established another committee to look at these proposals, and this committee also meets once a week to review what progress has been made. Currently, we expect that the first of these power plants, Formosa Plastics' Mailiao plant, will be installing its boiler in November.

Of course, the government's resolving of difficulties isn't simply to take care of just this particular investment proposal, but the method we've employed in dealing with it can also be applied to other companies. It's in this area that we have to carefully consider fairness issues. We also have to look seriously at environmental protection. We cannot sacrifice social equality and our environment for the sake of attracting investment.

Stopping land speculation

Another important item, especially for small and medium enterprises, and one where obstacles are far too easily encountered, is the problem of land acquisition. For this reason, we asked Taiwan Sugar to look into the possibility of releasing some appropriate amount of its land. They estimated that they have about 10,400 hectares of land that they can release to private enterprises for their use under a "rent not sell" arrangement. This is land that can then be used for factories, cultural or educational venues, and environmental facilities.

Taiwan Sugar is making available more than 10,000 hectares. That's an enormous amount of land. From 1950 to the present, the total amount of land opened up for industrial development by the Industrial Development Bureau (IDB) has only been 12,000 hectares. And now we have Taiwan Sugar releasing an amount of land equivalent to all the land opened up by the IDB over the years, all at one go.

Q: Haven't some people responded by stating that if Taiwan Sugar gets the zoning changed on these lands to make them available for industrial use, even calculating rents based on officially assessed land values, the costs will be too high for small and medium-0 sized enterprises?

A: We're still gathering everyone's opinion on this kind of technical problem. We haven't yet reached a final conclusion. Taiwan Sugar has also put together a special committee to look into the problem.

I feel that the most meaningful aspect of this land release by Taiwan Sugar is the use of this "rent not buy" method. This will lower land-acquisition costs greatly for the whole business community, and will be especially helpful to small and medium sized enterprises. The important point in the use of this method is that it can rein in the tendency towards land speculation disguised as investment. Under the principal of "rent not sell," it is not easy for large enterprises to occupy land, because they won't be able to just rent land and do nothing with it. They won't be able to keep un-utilized land in the hope that scarcity will push up its value.

Face to face communication

President Lee has recently expressed the hope that Taiwan's investment problems can be resolved in the next six months. I think the important ones are those I've mentioned above. In order to speed up the implementation of our initiatives, I recently invited the Ministry of the Interior, the Environmental Protection Administration, the Council of Agriculture, the Deputy Governor of Taiwan Province, the provincial Housing and Urban Development Bureau, the Department of Reconstruction, and the National Police Administration to form a committee comprised of officials from various ministries and departments, and from various levels within such bodies. The committee gets together once a week and discusses every city and county in Taiwan. We are first analyzing all of Taiwan's cities and counties to see what investment difficulties they are currently facing. Then we are solving these problems one by one.

For example, tomorrow [Oct. 12] we will discuss each of the proposals for the first time. Our focus will be on Taoyuan County, the proposed site for most of the large investment plans. In addition to the relevant ministries and commissions, we have also invited Taoyuan's county chief and representatives from the relevant investment and land divisions of the Taoyuan County Government to attend. Together we'll take care of this issue. I believe that going through this kind of face-to-face process, with local governments and central government communicating directly, we can greatly reduce bureaucratic red tape. Local governments are willing. It takes care of local unemployment problems, increases tax revenues, promotes prosperity. . . . Local governments benefit greatly. It is equivalent to the central government providing a service to local governments. This is the so-called "single window" method.

Government and economy are inseparable

Q: At the same time as promoting the "Invest in Taiwan" initiative, do you mean to restrict outward investment?

A: I think I can answer this in two parts. The first is investment in other countries. Currently we have the so-called "Look South" policy [which encourages investment in Southeast Asia] in which we are still engaged. There is a complementarity between an industry and the nation in which it is based; for industries and products which can no longer be competitive in Taiwan, we want to encourage southward investment. With regard to those which are less complementary, the government doesn't so actively encourage their movement south. But, in principle, we don't prohibit such investment.

As for mainland investment, we must understand that Taiwan's mainland trade and investment policy revolves around the axis of Taiwan's political policy towards the mainland. The problems in cross-straits relations very definitely affect the degree of openness in our economic and trade policies towards the mainland. Even up to the present day, the mainland is still not willing to talk to us. There are not even channels for discussion. This kind of situation makes the security of mainland investments something which must be considered.

So now we ask business people investing in the mainland to be very cautious. What this use of caution means in principle is that there are three kinds of mainland investment: allowed, prohibited, and special review cases. Allowed investments are still given approval. Prohibited investments are still prohibited. However, now we are evaluating special review cases more stringently.

These special review cases are mainland investments which are, in principle, prohibited, but can be granted exceptional approval. Now, in what circumstances can they be approved? Basically, it's when approval will benefit the nation's security or economic development. In the current situation, with cross-straits relations being less than ideal, if small and medium sized enterprises are having difficulty growing in Taiwan, we won't prohibit them from investing in the mainland. But, if it's a large enterprise, an important industry, or an infrastructure investment, the movement of these kinds of investments into the mainland one after another is not beneficial to our national development, and we must take more stringent measures. However, these policies change along with the changes in cross-straits relations. If relations were to improve, the situation would be different. All of this is flexible.

Precedence to the collective good

Q: Recently, the Council for Economic Planning and Development has been promoting the Asia-Pacific Regional Operations Center. This gives one the feeling of radiating out from a Taiwanese hub, but this "Invest in Taiwan" initiative gives one the feeling of pulling things back in. Doesn't this contravene the internationalization and liberalization of Taiwan's commerce?

A: I don't think it does. The foundation of the Asia-Pacific Regional Operations Center starts with the legal structure. We're doing our best to untangle it, to internationalize, to liberalize, and to build a good investment environment. We hope that in this way we can attract some well-known international manufacturers to Taiwan. The "Invest in Taiwan" initiative is an effort to encourage businesses to move more substantially towards investment here. Only if we further develop Taiwan's own economy will we have the ability to internationalize. Isn't that right? There's no conflict.

If today, the inclination to invest domestically drops to very low levels, if the unemployment rate becomes high, if the index of industrial output slides and trade slides, what internationalization will there be? The economy would collapse. What we are doing now is "strengthening the foundation."

Q: But aren't collective benefit and individual benefit locked in something of a see-saw struggle?

A: Of course. But I think that standing in the position of a government official, collective benefit must be the priority. If you want to allow every individual to achieve the greatest individual satisfaction, in the end it will most certainly have been done at the sacrifice of the collective good. It's impossible to make everybody happy. But we always consider manufacturers' individual needs and the collective good.

For this reason, in increasing domestic investment, domestic demand is also very important. We need to stimulate domestic interest in buying things. So now the Commerce Department of the Ministry of Economic Affairs has a complete set of plans for commercial modernization with which to provide the best shopping environment, the best shopping atmosphere, and thus encourage consumers to buy. We have considered all of these aspects.

No right to pessimism

Q: Currently many investment proposals are being held up by environmental concerns. The Taiwan Cement proposal that you just mentioned is one. Though the decision has been made to recommence work, thus far it has been impossible to get started due to public protests. Do you know of a better way to handle these matters?

A: Environmental protests are a major problem in Taiwan. Of course environmental protection is very important, and without it our children and grandchildren may inherit a place not worth living in. But environmental protection should be rational. Most importantly, there should be an objective agency or organization which can evaluate everything, so that everyone can trust in the outcome. Now we have the "Environmental Impact Assessment Law," but even when these assessments come out, people don't accept them, which undermines public trust in government. Then we have the proposed "Methods for Selection of Environmental Assessment Commission Members" that has been stuck in the provincial government for a year and eight months, and can't get out of the Provincial Assembly, so there needs to be improvement in this area as well.

Looking at it from another angle, if any environmental harm does occur, there must be an objective body that can fairly reach a judgment. And once a decision is made, people should accept it. At the moment, if any problem arises, everybody starts bellowing for sky-high compensation, and then bargaining begins. So each case must be handled as unique, unsystematically, and this wastes resources. And these cases always end up creating trouble between the government and citizens, and between the business community and citizens. Moreover, these incidents deter others from investing in Taiwan. If in the future business people don't dare invest in Taiwan, Taiwan will have no economy, and without an economy, Taiwan would be finished. Taiwan can only achieve long-term stability and tranquillity if this problem can be resolved.

Q: Are you optimistic about this?

A: I don't worry myself with optimism or pessimism. I will work hard to get the job done. I think in Taiwan's current circumstances, all things are difficult. But you still have to resolve them. And if you can't resolve them, Taiwan's future will look bleak. So we have no right to be pessimistic-we must all get together and get to work.

p.94

An intense man who emphasizes getting results, Minister of Economic Affairs Wang Chih-kang has already gotten the "Invest in Taiwan" ball rolling. (photo by Hsueh Chi-kuang)

p.96

Elements of the Movement to Upgrade National Competitiveness

(chart by Tsai Chih-pen)

p.97

Rate of Change in Investment Over Time

Investment in machinery by private firms (unit: rate of change in constant 1991 dollars)

Private fixed investment (unit: rate of change in constant 1991 dollars)

(Source: Directorate-General of Budget, Accounting, and Statistics. Chart by Tsai Chih-pen)

p.98

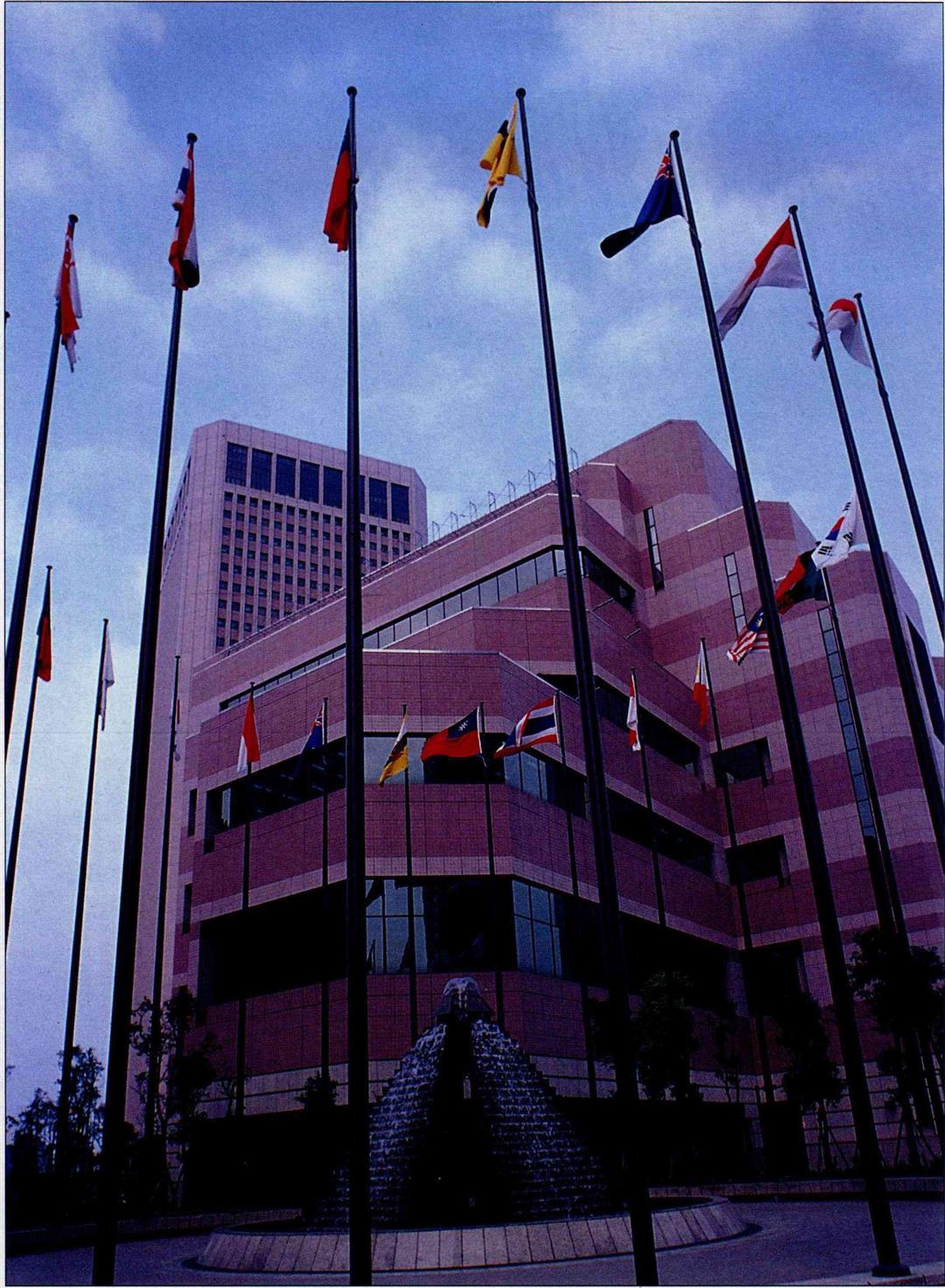

(right) The Taipei World Trade Center, where leaders of industry and commerce gather; economic vitality is Taiwan's lifeline. (photo by Diago Chiu)

(right) The Taipei World Trade Center, where leaders of industry and commerce gather; economic vitality is Taiwan's lifeline. (photo by Diago Chiu)