One of the minor benefits of marriage for Li-mei and Ta-shan Wang was to be the economics of living together. To some degree that was true; however, they hadn't counted on the taxman interfering with their marital bliss. The newlyweds found they were paying more than 30 percent more in income tax after marriage than before, when they filed as individuals.

Starting this year couples like the Wangs will not suffer as much financially from the vagaries of love. The government initiated a series of tax reform measures late last year designed to drastically cut the income tax burden of individuals (see attached charts). In the case of our newlyweds, it will mean a savings of about US$250 per year.

For working couples like the Wangs that is, certainly, good news. However, for single-income families it means a relatively higher tax bill. Consider two families that both earn US$19,000 per year. Family A, with only a working husband, can now deduct a mere US$1,300 in income, while family B, with two incomes, can deduct three times that amount.

The complexity of tax law necessarily means that any revision will result in the correcting of some inequalities and the creation of others. Tax reform is a zerosum equation--some will lose while others will win, said Ch'en T'ing-an, a professor at National Chengchi University.

The government has only treated 'the symptoms and not the disease, said a tax expert familiar with the proposed changes. The basic problems of the system haven't been addressed, he said.

On July 1 of last year, the government formed a Tax Reform Commission to undertake a complete overhaul of the tax system. Its recommendations are expected in another year and a half. The commission is headed by Ch'en T'ing-an.

The R.O.C. has a relatively progressive income tax--the higher the income, the higher the taxing percentage. Chengchi University's Graduate School of Public Finance, Shu Wei-ch'u dismisses the complaints of the rich. "Taxing is a form of wealth redistribution; a way to redress some of the inequalities in society," he said. "All advanced countries in the world use some form of their power to tax in this way."

In addition, the wealthy are more likely to have gone further in the government-subsidized education system, to own a car and therefore to use the public road system more, to live in a neighborhood where public services are more complete, and so forth. "Their higher tax bill reflects nothing more than what they benefit from," Shu added.

A problem arises in the treatment of couples with the same income but where the wife earns more than the husband. Under the new laws, a wife's deduction will be raised to 30 percent of income earned, while the husband's will remain at 20 percent--the same as for single individuals. In addition, the married woman's income ceiling will be raised from US$6,400 to US$8,600, resulting in a maximum deduction of US$2,600 compared to a before-marriage maximum of US$1,300. Marriage now means a doubling of the woman's tax deduction.

In the R.O.C. a husband and wife must file joint returns. Income earners 20 years and older can file as independents. These are the only categories that taxpayers fall into.

In the United States couples have the choice to file separately or together with a joint return. If they decide to file jointly, their incomes are simply added together and divided by two to determine the taxable income under the unified tax table. Their tax from the table is then multiplied by two to determine the amount of tax to pay. This option is advantageous to couples whose incomes differ greatly. This greater flexibility is seen as being fairer than the present system now employed in the R.O.C.

The T.R.C.'s Secretary Chang Sheng-ho said that it is considering a similar provision in its discussions, but has not come to any conclusions.

The question of "tax free" categories of income is also being dealt with by the T.R.C. "Exempting whole categories of society from paying taxes only increases the tax liability for everybody else," said Ch'en T'ing-an.

The income of junior high school and grade school teachers, along with the military, is now totally exempt from income taxes. Because of the military's special status, nobody is complaining too much about their tax advantage. However, teachers are a different matter.

"There are no longer any reasons to exempt their incomes from the taxing system," said Lin Ch'uan, research associate at the Chung-hua Institute for Economic Research. People say that teachers have a hard time making ends meet. "But having a low salary and paying income taxes are two different matters," he said. "If they deserve a raise, the government should give it to them. But why should they be exempt when other people with the same income have to pay?"

The fact is that teachers are not the most unfortunate class of people in our society. "The government should correct this situation to avoid protests from labor groups in the future," he advised.

For an equitable tax system we need cooperation and coordination from both the central and local governments. "The government should create a new independent taxing authority with branches throughout the country," Ch'en T'ing-an suggested. He also claims that its independent status would ensure that it remains free from the political pressures inherent in the current system. The national nature of the organization would contribute to its efficiency and fairness.

More than a few groups suspect that the government will use the results of the T.R.C. as a pretext to raise taxes. "The T.R.C. is not a tax-raising or tax-reducing committee," said Ch'en T'ing-an. "The recommendations it comes up with will be designed to make the current system more fair and reasonable; that's all."

In working towards that goal, some will benefit and others lose. The commission does not expect the report to be greeted with the same applause from all sectors of society, he said. The government has already done the easy part by decreasing taxes. Now it is up to the commission to hammer out an accord that will benefit society as a whole, one member of the T.R.C. said.

The commission's initial report is due out in March and is expected to be a test of the package's chances of becoming law. Citizens' groups have already been formed to work with the commission in formulating a report that all sections of society will be able to accept.

There is sure to be a lot of horse-trading before this tax revision becomes a reality. But when it's all finished, the R.O.C. should be amore equitable place to live.

[Picture Caption]

Couples filing a joint return will no longer incur the "marriage" tax.

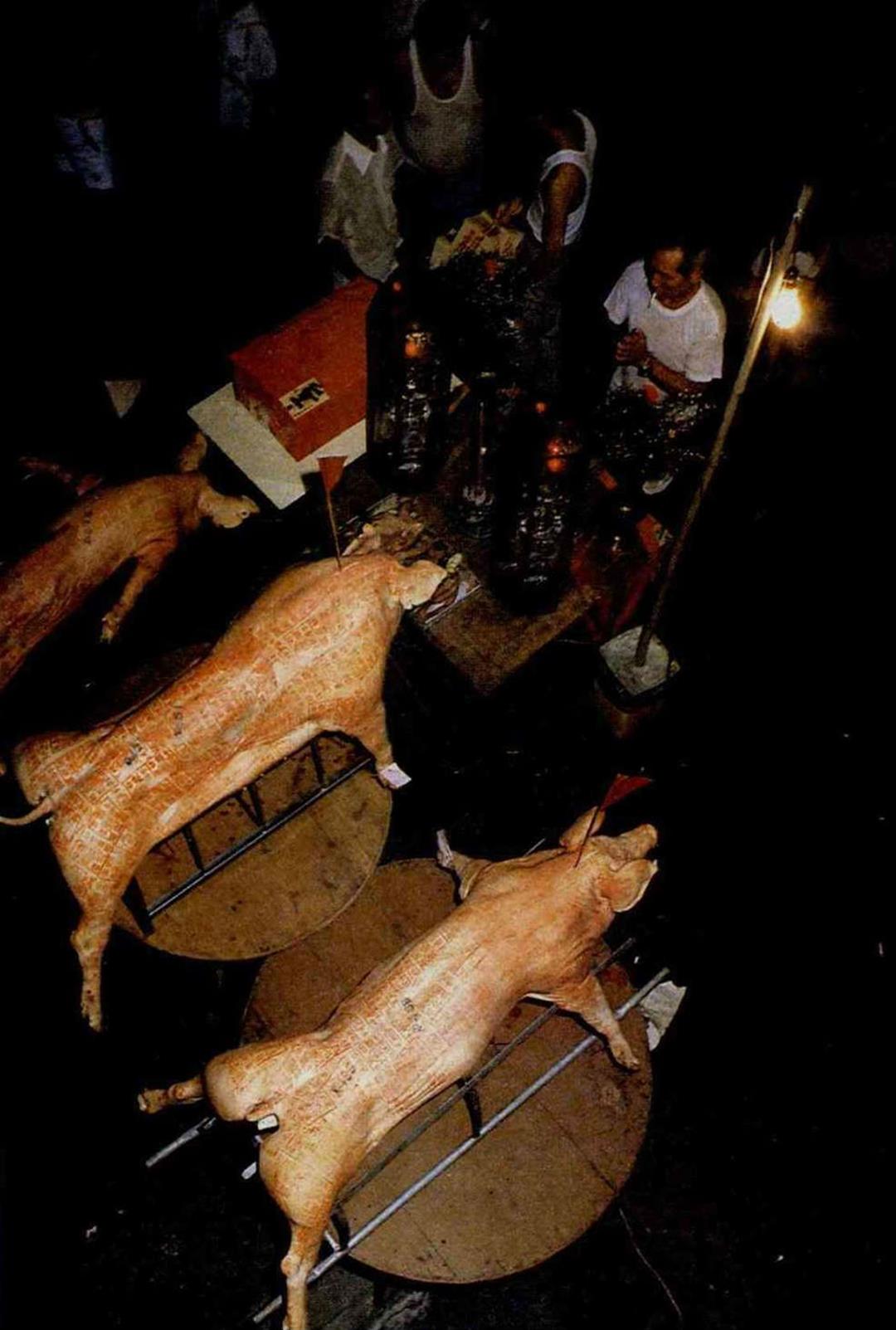

The government will lose NT$300 million a year by eliminating the slaughter tax.

The farmers' burden was eased a bit with the lifting of the agricultural land tax.

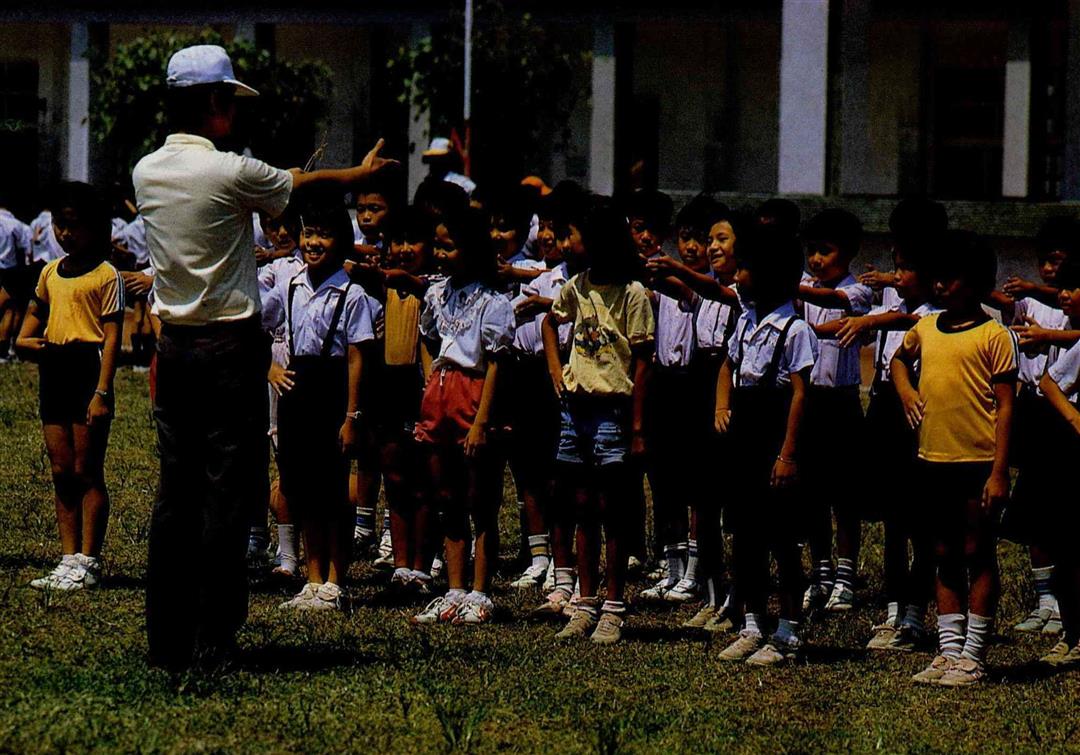

Does encouraging an academic foundation for the country no longer justify teachers a "tax-free" status?

The middle class accounts for 76 percent of all tax revenues.

Does labor shoulder more than its share?

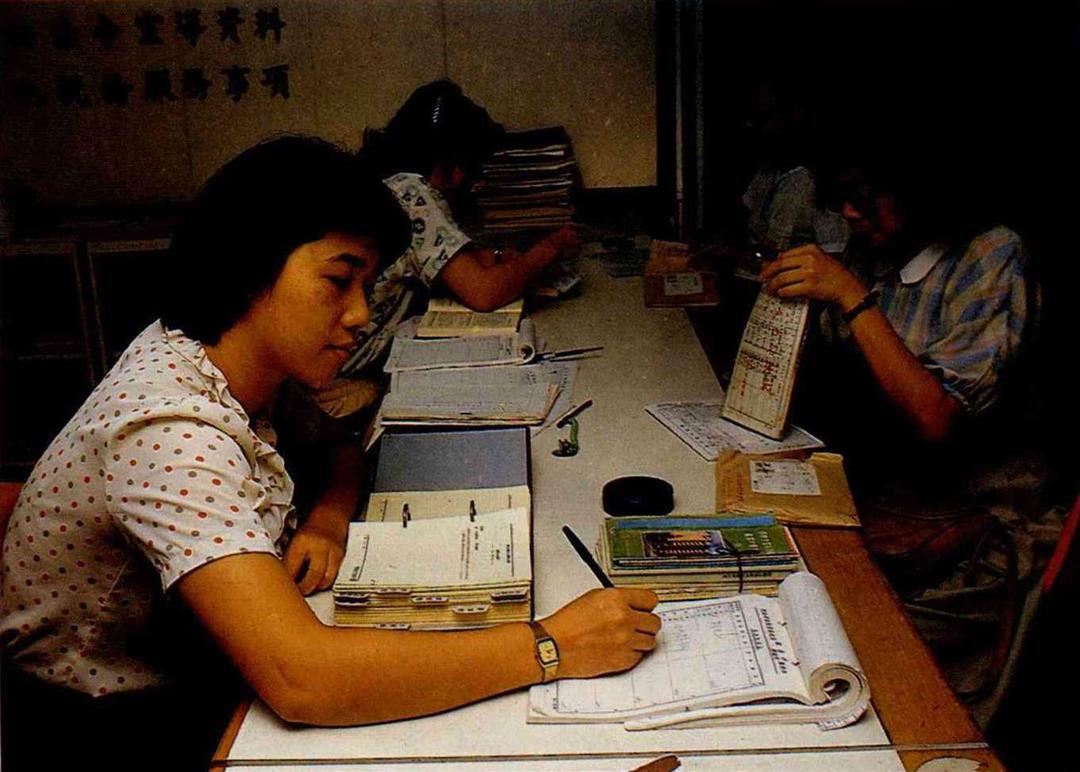

Workers at the National Tax Administration's customer service desk are busy answering taxpayers' questions.

Table 1: Comparison Between the Old and New Individual Income Tax Regulations

[Picture]

Table 2: Comparison Between Couples Filing Joint or Individual Returns

[Picture]

The government will lose NT$300 million a year by eliminating the slaughter ta.

The farmers' burden was eased a bit with the lifting of the agricultural land tax.

Does encouraging an academic foundation for the country no longer justify teachers a "tax-free" status?

The middle class accounts for 76 percent of all tax revenues.

Does labor shoulder more than its share.

Workers at the National Tax Administration's customer service desk are busy answering taxpayers' questio.