Taiwan’s Service Industries Come into Their Own

Coral Lee and Teng Sue-feng / photos Chuang Kung-ju / tr. by Scott Williams

April 2012

What drives employment and economic growth when the global export engine stalls?

A new forecast from the Council of Labor Affairs suggests that the private sector will need 55,000 more workers at the end of April than it did at the end of January, including 24,000 in the manufacturing sector and more than 30,000 in services. Compared with the same period last year, in 2012 personnel demand in the manufacturing sector has contracted by half, while that in the service sector has remained steady. The numbers suggest that domestic demand is strengthening. Can “local” services reinvigorate the domestic economy?

When restaurant chain operator the Wowprime Group listed on the stock market on March 6, chairman Steve Day and a group of company executives celebrated the listing by donning red sportswear and bicycling to Taipei 101, the home of the Taiwan Stock Exchange.

Wowprime’s listing was a media sensation. The company’s initial public offering was oversubscribed by a record 800 times, tying up some NT$100 billion in market funds. That led to it being expanded from 10% of the company’s capital stock to 60%, a record for the tourism and entertainment sector.

And the enthusiasm extends beyond Wowprime. Companies like Gourmet Master, the owner of the 85°C brand, and the soon-to-be-listed An Shin Food Services, owner of the MOS Burger chain, have seen their share prices soar to triple digits on listing on the stock or over-the-counter markets.

An example of this change in emphasis can be found in the behavior of TECO Electric and Machinery chairman Theodore Huang. He used to ask to be introduced as “TECO’s Theodore Huang” when making public appearances. Three years ago, he changed that, asking instead to be referred to as “MOS Burger’s Theodore Huang.”

The average salaries of Taiwanese workers have grown little over the last decade, leading to a rise in smart shopping. The photo shows UNIQLO, a Japanese discount clothier that opened its first Taiwanese outlet in 2010.

Service providers truly are having their day.

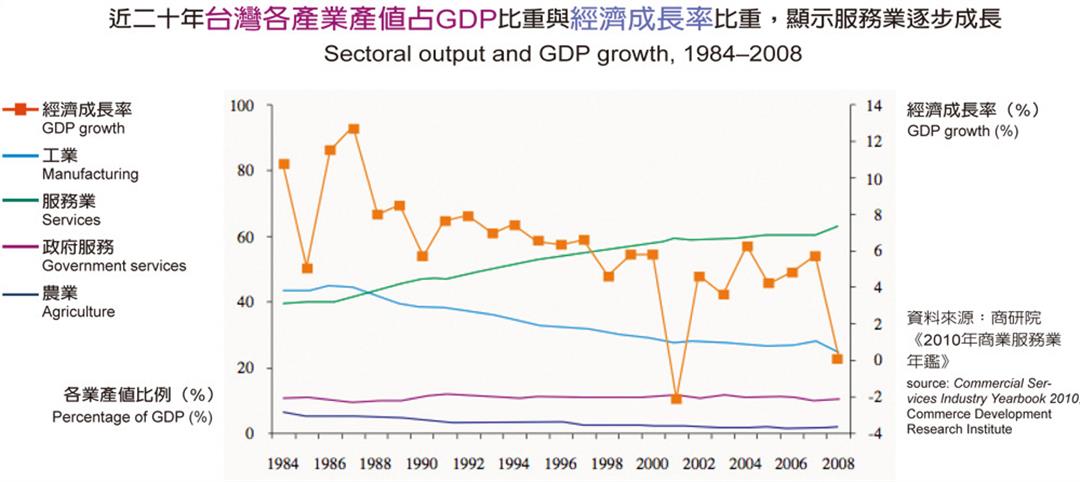

“Taiwan’s industrial structure has long been imbalanced,” says National Chengchi University economics professor Lin Chu-chia, “excessively reliant on information technology and plastics, and focused on economies of scale and cost cutting to enhance our export competitiveness. But even though we produce a lot of manufactured goods, the sector’s proportional contribution to GDP has been declining.” Lin says that because most Taiwanese manufacturers are OEMs, they contribute little value-added to Taiwan once you account for the costs of the materials they import.

In 2010, Taiwan’s service sector produced NT$8.7 trillion in services, meaning that its output was worth twice that of the manufacturing sector. Over the last five years, services have accounted for almost 70% of our GDP, indicating that Taiwan has already entered the service-oriented post-industrial era.

“Service businesses are those in which people provide services to other people; they involve human contact and require a lot of manpower,” explains Lin. If workers idled when manufacturing moves offshore transition into the service sector, where barriers to entry are low, it reduces unemployment. If they don’t, then the public is going to feel that the economy is weak no matter how amazing the growth figures may actually be.

Where manufactured goods such as cell phones can be made in China or Southeast Asia just as easily as in Taiwan, services such as dining, lodging, and transportation are local almost by definition. And by employing local resources and manpower, they maximize economic benefits.

Lin offers US search giant Google’s planned investment of NT$3 billion to build an Asia-Pacific data center in Changhua, which was approved in late 2011, as an example. Expected to open within two years of the start of construction, the incredibly expensive facility will employ only 20 people at most. In contrast, the NT$80 billion that has begun to be invested in tourism over the past few years is expected to create 10,000 jobs—19 times as many per dollar invested.

The quality of service in Taiwan’s restaurants and hotels is on the rise, a definite plus when seeking to attract international travelers. The photo shows Sunny Hills, a Taipei vendor of pineapple cakes.

A number of factors have thrust the new “stars” of the food and beverage industry into the spotlight. The impacts on manufacturing exports of the ongoing European debt crisis and the hazy outlook for the global economy have made this sector’s focus on domestic demand seem increasingly attractive by comparison.

“Over the last few years, the domestic food and beverage industry has grown at an annual rate of 2–6%,” says Wowprime’s Day. “As of last year, Taiwan’s per-capita income had reached US$20,000. This is a crucial milestone, one that fills us with hope for the future.” Day explains that inviting people to eat out has ceased to be a polite formula, and has instead become a way to genuinely further relationships. The food and beverage industry provides upbeat venues for this kind of socializing.

The rapid growth of the “fine food economy” is also related to social changes. Increases in the number of working women and double-income households, together with the fast pace of modern life, have decreased the frequency with which people cook at home.

According to the Directorate-General of Budget, Accounting and Statistics’ (DGBAS) Survey of Family Income and Expenditures, dining out rose from 32% of food expenditures in 2004 to 34.8% (NT$424.7 billion) in 2008.

But other economists believe that with domestic consumption accounting for some 60% of Taiwan’s GDP, the market is already oversaturated. If business increases at one restaurant, it is likely to decline at another.

Day’s response to this argument is that obsolescence drives progress. He says that the current growth is being driven by the cake getting larger, and believes that the present golden age will last for at least 10 more years.

Taiwan has now moved into the service-oriented post-industrial era. Service industries such as dining, shopping, luxury goods, or design all have the potential to support continued growth in domestic consumption.

Service businesses are by their nature customer oriented. In Taiwan, the bulk of these are retailers (approximately 620,000), which generally do very well. (They grew 6.6% in 2010.) And convenience stores, which have a higher penetration rate in Taiwan than anywhere else in the world, are perhaps the most tightly ensconced of all retailers in our everyday lives.

Taiwan has many convenience store chains, and competition is fierce, but Hsu Chung-jen, president of President Chain, is nonetheless optimistic about the industry’s outlook. He feels that with consumption diversifying and retailers innovating, logistics and services are becoming Taiwan’s future.

An early 2012 Eastern Online survey of consumer behavior in convenience stores found that 72% of respondents paid their telephone, gas, credit card, and other bills in such stores. Indeed, the move by convenience stores into financial and telecommunications services is only becoming more pronounced. The ubiquitous 7-Eleven chain illustrates this uniquely Taiwanese phenomenon: it handles about 16,000 bill-payment transactions per day with a total value of about NT$6.4 billion per year.

Many of Taiwan’s convenience stores have also recently begun renovating, increasing their floor space, installing restrooms, and adding tables by the windows to give customers a place to sit.

“In the past, a store would serve about 2,000 customers per day,” says Kung Ming-hsin, vice president of the Taiwan Institute of Economic Research. “Now that customers can sit down, they might buy a coffee with their newspaper, or a bowl of instant noodles on top of the oden they purchased to ease their hunger, turning it into a simple but full meal.” Such an increase in the average value of transactions, he believes, could deliver revenues equivalent to serving 4,000 customers a day.

In recent years, Taiwanese fine dining has experienced explosive growth, becoming a major tourist attraction. The photo shows a Le Blé Dor gastro pub.

It is striking how little the average salary in Taiwan has risen over the last decade—up from NT$34,489 in 2001 to just NT$36,271 in 2010. How could this fail to affect consumer markets?

According to Bei Lien-ti, a professor with National Chengchi University’s College of Commerce, the last three years of Eastern Online’s consumer behavior surveys show that the Taiwanese public’s monthly expenditures have recovered to pre-global financial meltdown levels. But because households continue to feel economically constrained, they are closely monitoring their spending. Even those with the ability to spend are carefully planning purchases and buying most of their items on sale. The hordes of shoppers turning out for department-store anniversary sales over the last couple years are evidence of the phenomenon.

Smart shopping is in evidence in both online and discount-apparel markets.

Some 6,000 lined up for Japanese discount clothier UNIQLO’s October 2010 grand opening in Taiwan. The company has gone on to open five more stores here. Taiwan’s own lativ, an online retailer, has regularly set sales records.

lativ, an Internet retailer founded in 2007, quickly gained a reputation for high-quality, inexpensive, down-to-earth clothing made in Taiwan. Positive word-of-mouth from its 250,000 members helped the company grow its annual revenues from the NT$10 million range to roughly NT$4 billion in 2011. Its success stems in part from a tightly focused product line consisting of clothing in simple styles at reasonable prices. The company also sets high standards for quality, which means that return rates are low. The strategy, which amounts to providing nice items at a good price, has won the hearts of consumers.

The company went on to experience too much success. Overwhelmed by too many orders, lativ’s domestic suppliers couldn’t meet demand, and it began farming out production to mainland China and Southeast Asia. Customers complained vociferously when it told them it would no longer place “made in” tags on its products, forcing the company to backtrack. It reintroduced “made in” tags and, having weathered the storm, may see revenues again reach new heights this year.

With global economic recovery still some distance away, the recent growth of domestic-demand industries has been driven by the opening up of the island to tour groups and self-directed tourists from mainland China. Moving forward, we need to find a balance between numbers of tourists and quality of service.

Taiwan’s service sector has potential, but although it accounts for almost 70% of GDP, it still only provides 30–50% of Taiwan’s real economic growth. As such, it has limited ability to drive economic development.

“This year, our excess savings rate reached a record high,” says Kung, “meaning that some people want neither to spend nor to invest.” Kung explains that excess savings are a nation’s total savings minus its total investment. The excess savings rate is this figure expressed as a percentage of GDP. From 2004 to 2008, Taiwan’s excess savings rate was 5–8%. In 2009, it climbed to 10.5%. This year’s excess savings are forecast to reach NT$1.5 trillion, a rate of 10.23%, a figure second only to that of the eve of the financial tsunami in 2009.

Kung reminds us that stable consumer spending growth is dependent upon growth in permanent incomes. In other words, consumers only feel comfortable spending when they know that their incomes will continue to grow in the future. The corollary of this is that when incomes fail to increase, domestic demand is very likely to stagnate.

One solution, says Kung, is to stimulate the consumption ability of high income earners. He explains that Taiwan’s top quintile in terms of household income have an excess savings rate of 35% and account for 70% of all of Taiwanese household savings. This quintile’s excess savings rate is 10 percentage points higher even than that of Japan’s top quintile. If these wealthy households were to cut their excess savings to Japanese levels, it would provide an NT$400-billion boost to the domestic consumer market.

Aside from stimulation of consumer demand, our service sector is in urgent need of structural transformation.

According to Tu Jenn-hwa, an associate professor in the Graduate Institute of National Development at National Taiwan University and director of the Department of Business Development and Policy at the Commerce Development Research Institute, Taiwan’s service sector is largely comprised of small and medium-sized enterprises that lack the resources to upgrade equipment or undertake R&D. Even those which would like to move out into the global marketplace are hard pressed to do so. They just can’t compete with giants like the US’s UPS or Germany’s DHL, shippers with global service networks, hundreds of their own airplanes, and enormous R&D capabilities.

Located near the Cologne/Bonn Airport, the DHL Innovation Center attracts hundreds of thousands of visitors annually. This “laboratory of tomorrow” focuses on developing new logistics solutions to meet client needs. Examples include a smart truck that figures out the best route from the point of collection to the point of delivery and a smart temperature sensor that monitors the temperature of goods in transit and has pharmaceutical and food transport applications.

Salaries are another issue for the local service sector. Low pay has long made it hard to attract and retain talent. Fortunately, salaries have begun to rise in recent years.

“Recruitment has been a major obstacle to the development of the tourism industry,” says Chai Chun-lin, vice chairman of Hotel National and chairman of the Taichung Tourist Hotel Association. He says that 30-some international-class hotels will be opening in Taiwan over the next few years, and expects their need to hire dozens of senior executives and hundreds of middle managers to initiate a battle for personnel.

In fact, many service sector enterprises have come to realize that skilled workers are crucial to improving their competitiveness, and are acting accordingly.

When Lung Yen Group built a 26-hectare cemetery at Baishawan in New Taipei City’s Sanzhi District two years ago, it hired renowned Japanese architect Tadao Ando to design the facility, which transformed interment from a local ritual into a branded corporate operation. Last year, NTU’s Department of International Business incorporated Lung Yen into its curricula as a case study. The school also began working with the company to develop internship opportunities for its students.

TourismBut given that Taiwan is at root an exporter with only a small domestic market, is the recent blossoming of the service sector destined to wither on the vine? Are any of the industries that make up the sector likely to flourish over time?

Kung says that because Taiwan’s economy is relatively small, consumer spending growth will depend not just on domestic demand, but on international trends. Spending will rise when consumers feel wealthy, which is to say, when the global economy and Taiwanese exports are booming.

Setting aside the question of the global economic recovery, many people see tourism as the best and most competitive of Taiwan’s service industries.

Mainland Chinese tourists have been flocking to Taiwan in ever greater numbers since being permitted to travel to the island in 2008. Their numbers eclipsed those of our Japanese visitors for the first time in 2010, when they accounted for some 30% of all visitors to Taiwan.

Last year, a record 6 million international tourists traveled to Taiwan and pineapple cakes were among their most popular purchases. Over the last decade, industry sales have soared from NT$1.5 billion to NT$25 billion, and Vigor Kobo is about to become the first company to list on the over-the-counter securities market on the strength of its pineapple cake sales. The company has introduced new technology and a spirit of innovation to Taiwan’s pastries industry, and has even gone so far as to build a NT$300-million “Pineapple Dreamworks” in New Taipei’s Wugu District. The attraction features a 10-meter-long escalator, constructed by the team that built the Pavilion of Dreams for the Taipei International Flora Expo, and designed to look like a tunnel through the heart of a giant pineapple, complete with buzzing insects and pineapple scents.

DiversifyingContending for tourism dollars is a must for every nation, and economist Ma Kai argues that tourism is even more important to Taiwan than manufacturing. “But so far we’ve been content with just crumbs,” laments Ma.

In his view, the problem is that Taiwan has focused only on mainland tourists, thinking that they represent easy money. He counters that relying on mainland tourists is even riskier than depending on exports to the mainland because trade has a reciprocity that tourism lacks. If the mainland were to halt cross-strait trade, it would harm itself as well as Taiwan. But if it were to stop its public from visiting Taiwan, only we would suffer.

Ma says that Taiwan’s natural and cultural assets are on a par with those of Thailand and Malaysia. Why then can’t we attract the large numbers of European and American tourists that they do? One reason is that over the past decades, both government and the industry have paid scant attention to the task of developing the fundamental capabilities of the tourism industry. Another is that the corrugated-steel buildings and plethora of vendors that populate Taiwan’s scenic areas give the sites a third-world look. Still another is that our accommodations are more expensive than those of Korea in spite of the latter’s higher cost of living. If we are to diversify our risks, we have to turn the industry around and begin attracting tourists from other nations soon.

When it comes to a blueprint for the development of Taiwan’s service sector, research conducted by the Ministry of Economic Affairs suggests that we should not only develop our “fine foods economy,” but also aim to be the Chinese-speaking world’s premier destination for affordable luxury, a shopping paradise, an Asian hub for advertising services, and Asia’s top expo and convention center. All have potential and all will require fostering cooperation between industry and academia, honing the private sector’s development skills, and cultivating multidisciplinary talent to succeed.

Fine foods, tourism, online shopping, healthy living, pet care… the industries of the service sector are mutually reinforcing. If we develop them one step at a time and stay grounded in reality, we will all benefit from the improvements to Taiwan’s service sector.

@List.jpg?w=522&h=410&mode=crop&format=webp&quality=80)

@List.jpg?w=522&h=410&mode=crop&format=webp&quality=80)